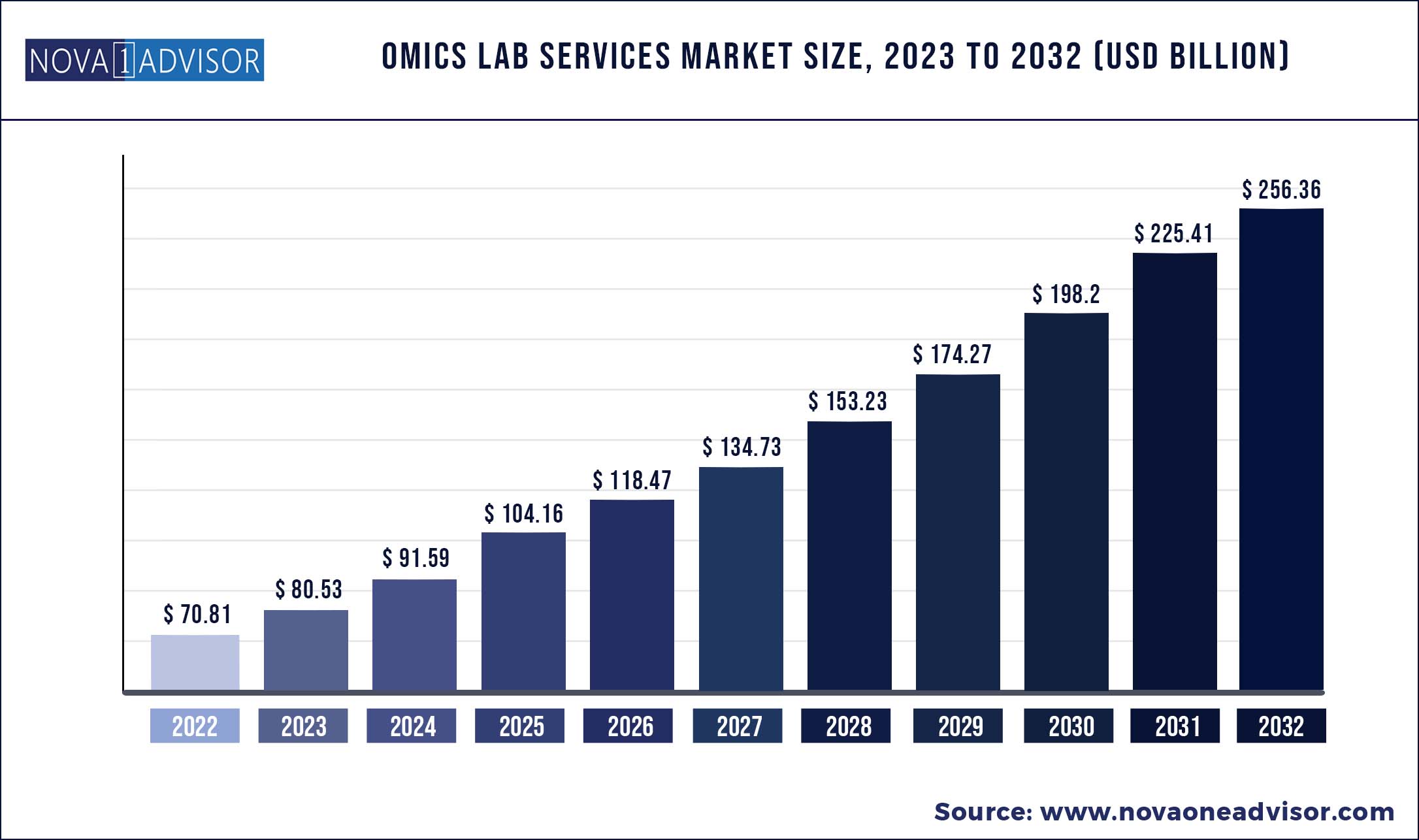

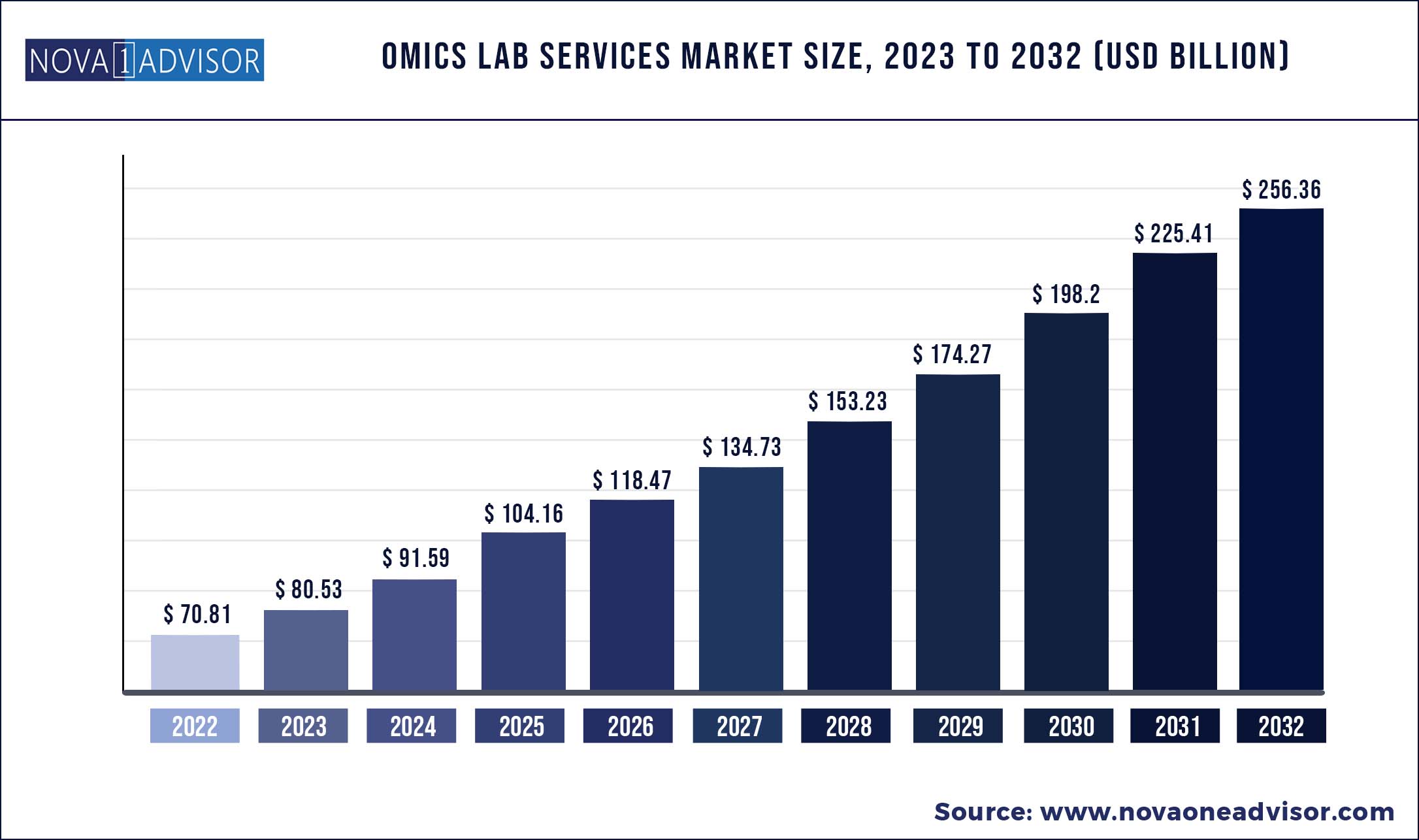

The global omics lab services market size was exhibited at USD 70.81 billion in 2022 and is projected to hit around USD 256.36 billion by 2032, growing at a CAGR of 13.73% during the forecast period 2023 to 2032.

Key Pointers:

- Epigenetic segment is expected to show fastest growth during the forecast period which can be attributed to the future potential offered by epigenetic analysis

- Diagnostic labs segment held the largest market share in 2022 owing to the rising testing and availability of the wide range of resources for performing diagnostic tests

- Hardware equipment segment dominated the omics lab services market in 2022 and is anticipated to show at fastest growth rate during the forecast period owing to Rapid technological advancements in genomics and transcriptomics through the development of hardware equipments

- North America held the largest market share which can be attributed to the increasing adoption of genetic testing due to its high accuracy, sensitivity, and specificity

Omics Lab Services Market Report Scope

The development of the market is attributed to growing integration of the genomics data into clinical workflow and rising adoption of direct-to-consumer omics. Moreover, rising demand for early disease diagnostic test, technological advancements aided with increasing government funding is further propelling growth of the overall market.

Growing recognition of omics' potential in human disease management and other nonconventional applications has fueled the implementation of omics data. This, in turn, has increased competition among firms to introduce products and technologies by leveraging available genetic information, capitalizing on the ample growth avenues in the market. Advanced laboratory analytics also support the development of precision and personalized medicine, which has an influence beyond general patient care. Thorough progress has already been made in the field of oncology, and developments in omics and single-cell micro technology have greatly benefited progress toward upcoming patient-centered approach.

Moreover, the field of oncology has benefited most from omics research, and one newly developed use of NGS clinical tests is for the quantification of circulating tumor DNA (ctDNA) from plasma. Numerous NGS technologies, such as Cancer Personalized Profiling by deep Sequencing, may be used. High-throughput RNA sequencing developments have brought light the importance of transcriptomics in biological and clinical research. RNA sequencing using NGS technologies or microarrays are two ways to perform transcriptomics. Proteomics and metabolomics are two domains that have been significantly characterized by improvements in NMR and MS technologies.

Furthermore, key players operating in the market are focusing on incorporating omics technology in early diagnosis. For instance, in May 2021, Burning Rock Biotech Limited launched PRESCIENT, first pan cancer, multi omics early detection study in China. In March 2022, PrognomiQ invested USD 46.0 million in advancing development of multiomics for early detection of cancer. In September 2022, Bertis launched Proteomic based research of its new biomarkers for diagnosis of ovarian cancer. Moreover, in July 2022, Mission Bio, Inc. launched Tapestri platform for single cell multiomics-based MRD detection in blood cancers. These initiatives and research in the field of omics for the development of early diagnosis tools is further propelling the overall omics labs services market growth.

Some of the prominent players in the Omics Lab Services Market include:

- Agilent Technologies, Inc.

- Beijing Genomics Institute (BGI)

- Q2 Solutions

- Spectrus

- Flomics Biotech

- PhenoSwitch Bioscience

- QIAGEN

- Quest Diagnostics Incorporated

- Thermo Fisher Scientific, Inc.

- Illumina, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the global Omics Lab Services market.

By Services

- Genomics

- Proteomics

- Transcriptomic

- Metabolomics

- Epigenetics

By End-Use

- Hardware Equipment (Instrument, Kits, Chips)

- Testing / Lab (Services)

- Analytics / Interpretation (Personalization and Interpretation)

By Product

- One-off

- Repeat

- Continuous

By Frequency of Service

- Hospitals

- Research Institutes

- Diagnostic Labs

By Business

- Cancer

- Pharmaco

- Prescription

- Non-Prescription

- Reproductive

- Other Genetic Tests

- Forensics

- Population Studies

- Skincare

- Nutrition

- Vitamins and Supplements

- Genealogy

- Other Categories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)